While Kentucky families struggle to make ends meet, the federal government continues to borrow and spend without inhibition or a proper understanding of what's at stake.

Data released by George Mason University's Mercatus Center shows why the federal debt should concern Kentuckians.

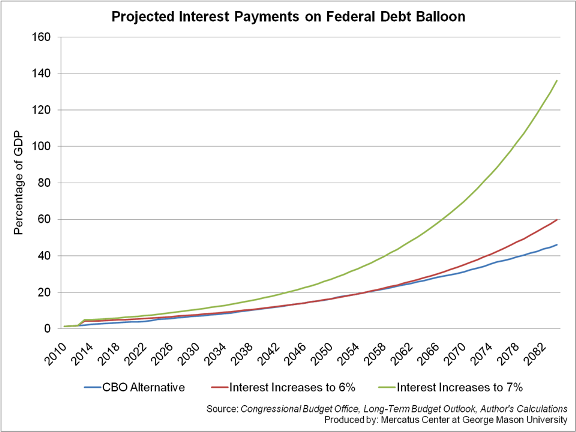

Senior research fellow Veronique de Rugy illustrates in the graph below how interest rates will soar if current trends continue and lenders realize how risky it is to invest in the American government. By 2084, interests costs could soar to 136 percent of GDP.

How can our government swallow that?

Senior research fellow Veronique de Rugy illustrates in the graph below how interest rates will soar if current trends continue and lenders realize how risky it is to invest in the American government. By 2084, interests costs could soar to 136 percent of GDP.

How can our government swallow that?

Kentuckians should be troubled by these developments.

De Rugy warned:

"Large and sustained deficits and debt inevitably cripple economic growth. The money the federal government borrows comes from Americans’ savings. So does the cash that Americans invest in private sector growth. There comes a point where there just aren’t enough savings to satisfy both masters. Unfortunately for economic growth, the government always helps itself first."

To read more about America's debt and solutions to fix it, read de Rugy's piece in Reason Magazine.

3 comments:

You're making this too difficult. All you have to do is print more money!

Or take it from "the rich".

Do you mean "the evil" business owners that put people to work?

Post a Comment