The State Journal's Paul Glasser is the latest reporter to botch the Gov. Steve Beshear pension scheme story:

Beshear's plan delays the requirement that cities and counties catch up on funding their woefully underfunded health and pension benefits plans. The alternate universe mentality that pervades Frankfort and most of the mainstream media emboldens some to spin Beshear's move as a good thing, but pretending that he is saving money for anyone with this just isn't true.

Wednesday, December 31, 2008

No, it won't

Good sign of a bad idea

When Governing Magazine doesn't like a big-government tax scheme, you know it's really bad news. Take, for example, corporate welfare for motion picture productions:

"During the past fiscal year, according to a recent study, New Mexico granted $38.2 million in tax rebates for TV and movie production, but in return saw only enough increase in economic activity to generate $5.5 million in public revenue. "For every one dollar in rebate," the study concluded, "the state only received 14.44 cents in return.""

"Over the past five years, all but 10 states and some cities have created film-incentive programs. This has spread production around, but no one has come up with a formula that can be shown to provide a net economic benefit for the state or locality itself."

As if on cue, Kentucky is getting in on the act with Rep. Tommy Thompson's pre-filed effort to match New Mexico.

Leland Conway on good government

By Leland Conway

Recent surveys show a disturbing trend toward a politically ignorant American electorate. An exit poll on Election Day found that a majority of voters were uneducated on many of the most important issues facing America. Unfortunately for us, this is a terrible time to hand the future of our nation and our communities over to ignorance.

Kentucky is facing an enormous economic crisis. This is not altogether different from any of the other 49 states as our nation suffers from the worst recession since the Second World War. As clouds gather, our legislators are preparing to converge on Frankfort with one thing on their minds - money. They are absolutely determined to find new ways to “raise revenue.” Translation: Higher taxes.

Yet we cannot blame our legislators alone. Sure, they are en masse an ignorant group which lacks significant leadership. But ultimately we must look to ourselves to find responsibility for the mistakes that they are no doubt about to make. We elected them.

During the election cycle you heard many pleas to “get out the vote.” They claimed that voting is our most precious right as Americans. If that is so, then why do we treat this precious right the way we do? Why do we fail to recognize that every American right is comprised of two ingredients, the one being the liberty to do a thing, the other being the responsibility to do it to the best of our ability?

In the early days only property owners could vote. Called “Freeholders”, it was assumed that those who had carried the responsibility of owning land and making it productive would also be those who were most affected by government and would likely be educated when voting. Times have changed, and I am not advocating that only land owners should be allowed to vote, but I am in favor of some sort of litmus test that proves that anyone who is pulling the lever at least has some idea of the consequences of their decision.

For the time being I am willing to admit that the political climate doesn’t bear out the possibility of creating a voter test, so we must deal with this by controlling that which is in our power to control. Those of us who are concerned about limiting government and increasing liberty need to become far more active citizens. T o that end, I implore the readers of this column to become more engaged in civic life. From local to national it is imperative now more than ever that the citizens return to their rightful role of holding government accountable for its actions.

If you, like me, are becoming more disgusted by the bilge water coming from our elected leaders, then it is time to take a more active role in their decision making process. Close on the heels of an active citizenry follows good government. Or at least government as good as it can be.

A truly active citizen needs no assistance in communicating with their representative, so I won’t waste your time by giving you contact names and numbers. I will however point you to one very useful tool. All you need is internet access to keep a good eye on legislation being proposed in Frankfort this session. www.kyvotes.org is an extremely useful tool for keeping watch over the juveniles in the legislature – at least until we can replace them with someone who will better represent limited government and increased liberty.

In the current “bailout” climate, the voters may not be able to vote themselves a check, but we can bail out liberty by holding our leaders accountable.

Tuesday, December 30, 2008

What Happens When Special Interests Override Education Choice and Equal Opportunity

Jody Richards’ kids at WKU get the free “Charter School” college called Gatton Academy and free dual credit courses.

Harry Moberly’s kids at EKU get…………This.

More Turbulence at Shawnee High School

Louisville’s Shawnee High School has earned more than its share of Bluegrass Institute attention over the years.

In our “How Whites and Blacks Perform in Jefferson County,” Shawnee produced some of the lowest high school graduation rates for both white and black males of any school in the Jefferson County school district, and the five-year decline in black male graduation rates in this school was the largest of any high school in Louisville.

In the Institute’s “Bang for the Buck,” Shawnee turned in the worst performance in the state when we compared test scores (the “bang”) to per pupil expenditures.

Others agree that Shawnee is a troubled school. It has failed to meet No Child Left Behind goals for years. According to Ann Elmore, a Jefferson County school board member, the school struggles with test scores, attendance rates, and discipline issues.

Now, the Courier-Journal reports a proposed district-wide attendance plan for schools – aimed at improving all of Louisville’s schools – is raising more concerns that Shawnee will be left behind, again.

Per the Courier, the district’s plan is supposed to leave no school with, “more than half its students from low-income, low-education and high-minority neighborhoods.” But, the plan won’t accomplish that for Shawnee, where 87 percent of the students will still come from disadvantaged homes.

The “fix” is supposedly making Shawnee into a magnet school. But, hold on. Shawnee already is a magnet school with a special aviation program, and that has not worked. The district appears to be out of ideas to fix this troubled school.

If ever there was a need for more school choice options such as charter schools largely free from the restrictions that tie Jefferson County’s hands, Shawnee has to be a prime example. For example, the Knowledge is Power Program (KIPP) charter schools in other states do a great job despite high ratios of high poverty enrollment, but Kentucky first needs to legalize charter schools before we can adopt a KIPP model.

Maybe our legislators will finally learn from Shawnee’s long-time plight and finally give our state what kids in more than 40 states already have – a charter school law that can really work for our students – even when they’re in high poverty situations.

Competition in School Breeds Success -- In Texas

Kentucky’s educators cringe at the very thought of kids competing in school academics. But, one teacher down Texas way has broken the code – done right, it works. Here’s the story.

If any Kentucky teacher ever tried this approach, I certainly never heard about it.

That didn't take long

Remember way back in June when Gov. Steve Beshear and the General Assembly got together to "fix" the public employee benefits system? They created payment schedules to get the funding of the various pension and health benefit plans up so the state might not go bankrupt.

They have already starting backing up on the deal.

Beshear promoted in a press conference today a bill by Rep. Mike Cherry that kicks the funding schedule for county governments' health plans to the curb.

Those plans were already $5.35 billion underfunded on June 30, before the stock market tanked. That is the most recent data available.

This move is being promoted as a $37.5 million bailout of the local governments. The point is that something will always come up that prevents our politicians from properly funding these liabilities.

The latest unfunded liability figure for all the public employee plans is $29 billion. There will never be an easy time to make those payments. If we continue the head-in-sand routine, we will soon face something much like what California now faces.

There's a bailout provider born every minute

Lee Iacocca knew when he got the federal government to save Chrysler with loan guarantees in 1979, it was a one-time deal. The current auto bailouts look like a way of life for us going forward.

Just as cities and states turn to Uncle Sam for some trillion dollar love, everyone has to know that once won't be enough. Rewarding the bad habits that got our big-spenders into trouble will practically guarantee it.

In that context, it is interesting to see a Louisville elementary school PTA featured in the Wall Street Journal for "discussing helping to pay the salary of a teacher aide whose job might get cut."

It's not hard to imagine that turning into a trend. In fact, at the end of the article, another parent group extricated itself from just such a mess:

"The Eldorado Community School PTA in Santa Fe, N.M., this year has put the brakes on funding teacher salaries after it raised $61,000 last year to save a physical-education instructor's job. "After that we decided we're not going to pay district responsibilities like salaries" because of concern that it was setting a precedent that could not be maintained, says PTA president Kathy Ritschel. To the district, "we said, 'You guys figure it out.'"

Every school district in Kentucky must post every dime of expenditures on the internet so taxpayers have the information to judge the needs of their local schools. This should be done before any more parents get sucked into a similar scam.

Monday, December 29, 2008

What's prevailing wage for posting sale signs?

The Boston Herald reports Massachusetts, New York, and Minnesota are looking into selling their state lotteries and other assets to help clean up their fiscal situations.

Kentucky can possibly try to borrow money to get through the current downturn and hope for the best, but the more solid strategy for Kentucky taxpayers would be getting state and local government out of a lot of businesses.

Now that Sen. Mitch McConnell is starting to respond to calls to halt the bailouts, Kentucky needs to move quickly to get its house in order. Remember, even if we get a bailout our state budget is still structurally unsound. And unless President Obama plans on giving us $33.4 billion, we still have our public employee benefits mess heading our way like a freight train.

Newsflash: state fringe benefits still too high

The Kentucky public employee benefits plans were underfunded by $29 billion as of June 30, despite House Speaker Jody Richards' suggestion that same week that the General Assembly had just fixed the problem during their expensive special session.

There can be no question the problem is far worse now.

So, Gov. Steve Beshear has called a press conference for tomorrow at 11 am to make an announcement "regarding pension reform."

A Beshear spokeswoman declined to offer any details of his plan prior to the dog-and-pony show.

Maybe we will have another Blue Ribbon Commission.

Nothing positive will happen on this front until public employee benefits in Kentucky are scaled way back to more closely reflect what is available to taxpayers in the private sector. And more government spending must immediately be redirected toward lowering the unfunded benefits before Kentucky goes bankrupt.

Aren't you glad Beshear isn't blocking blogs?

While you are worrying about how hard your government is going to hit you with tax increases, some state employees are using our time, money, and computers to search double-dipping tips for the political class.

Click the image below to read it:

You'd better work harder because these folks are getting ready to hit your credit card like it is going out of style.

Sunday, December 28, 2008

Still trying to tax us to prosperity

Various Frankfort politicians and journalists spent much of 2008 failing to convince us that a cigarette tax would help balance the current budget, pay off pension debt, fund new health programs, and fund new education programs while cutting demand for cigarettes. So I should be used to ridiculous overselling of tax increase virtues.

But I almost fell off my chair while reading New York Times columnist Tom Friedman promote the idea that a gasoline tax increase would be the best thing Barack Obama could do.

I kid you not:

"A gasoline tax would do more for American prosperity and strength than any other measure Obama could propose."

And, of course, it gets better:

"Today’s financial crisis is Obama’s 9/11. The public is ready to be mobilized. Obama is coming in with enormous popularity. This is his best window of opportunity to impose a gas tax. And he could make it painless: offset the gas tax by lowering payroll taxes, or phase it in over two years at 10 cents a month."

Can't imagine anyone falling for this, can you?

Saturday, December 27, 2008

Actually, it's very simple

Nobel Prize winner Paul Krugman may be a great economist, but as a blogger he needs some work.

On his New York Times blog, making fun of people who don't want a massive federal bailout of cities and states, Krugman said:

"...if you believe that a surge in private spending would raise employment — and even the critics agree on that — it’s very hard to explain why a surge of public spending wouldn’t have the same effect."

Private spending wouldn't be borrowed money that taxpayers have to pay back with interest.

What's $56 million to a journalist?

The Lexington Herald Leader is at it again.

From their big story Saturday headlined "Putting a price on smoking" comes this statement, unattributed to anyone:

"Democratic Gov. Steve Beshear has proposed a 70 cent per pack increase in Kentucky's excise tax as a way to improve the state's finances. The increase would generate more than $200 million a year for state coffers."

Where did this number come from? Maybe we should get reporter Sarah Vos and AP reporter Roger Alford in a room together to explain. In a story published December 21 in the same newspaper, Alford wrote:

"Beshear, looking for ways to raise revenue to offset some of the nearly $1 billion in shortfalls, proposed in December raising the state's cigarette tax to $1 a pack and to double the tax on snuff and other tobacco products. That move, which Beshear believes is politically acceptable to most Kentuckians, would generate $81 million this fiscal year and $144 million the next - not nearly enough to offset the revenue losses."

My newswriting professor would have had a field day with these two. What's worse, their projections certainly make no provision for the people in five states bordering Kentucky who now buy their cigarettes in Kentucky, but would no longer do so if the tax went up as proposed.

That fact will take a big bite out of any hoped-for revenue increase.

This whole thing is very simple. Rather than cut spending for a government that is already too big, these advocates want to get lawmakers on the record supporting a tax increase, then they want to spend the projected inflow of cash, and then they want to raise taxes again when the projections don't work out as promised.

It would be better to provide the public better information about where our money is being spent so taxpayers can make better decisions about where to cut and we can communicate our desires with our representatives based on facts, not spin.

Friday, December 26, 2008

Cutting off your child's nose to spite his face

Kentucky has been operating on unsound budgets -- and filling in the gaps with borrowed money -- for several years. Now the tactic seems to have come to a head. The state approaches the midpoint of the fiscal year with revenues that are higher than ever before, but it still isn't enough.

Gov. Steve Beshear and House Majority leaders have been spinning like crazy in favor of a cigarette tax increase to save the state. The state's two biggest newspapers have played along as dependably as ever.

It's a bit of a surprise, though, to see the newspaper of a conservative county like Jessamine getting in on the act.

Falling for the idea that propping up Frankfort's overspending ways and maintaining current funding levels "for the children" with just one little old tax increase merely continues the practice of sacrificing fiscal sanity to political expedience. If voters fall for this, their children will pay for it.

Year Round School Fad Flopping

The Courier-Journal reports that four of the six remaining Louisville schools that still use a full, year-round calendar for classes (no traditional summer breaks), are dropping this once highly touted education fad idea.

Jefferson County Schools superintendent Shelly Berman wants to drop this expensive program in the two remaining schools, as well. The school system can save about $400,000 a year if all six schools go back to the traditional calendar.

I took a quick look at the CATS performance of the four schools that are dropping year-round schedules on their own. They are the Dixie, Breckenridge-Franklin, Roosevelt-Perry and Rangeland elementary schools. Only one of these schools met its undemanding CATS goal in 2008. The other three only made it to the “Progressing” category, and two of those three were in “Progressing – Decline,” which means their scores were lower in 2008 than in 2006. Proficiency rates in the four schools in math and reading ranged from highs only around 60 percent to lows around 40 percent.

Says Superintendent Berman, "I don't believe having a year-round calendar is the most effective system out there.” After 18 years of expensive reform, the lackluster performance cited above substantiates his comment.

Thus, another KERA education fad seems to be a slowly dying ember, joining math portfolios, performance events, whole language reading without any phonics, fuzzy math, and a host of other poorly researched theories that Kentucky educators once told us were the “research shows” best education practices.

On being afraid, very afraid

The current economy has been increasingly compared to the Great Depression of the 1930s in the popular media. In that context, it is striking to read a New York Times story about school choice in New York and the trials and tribulations of middle-school parents.

A two-sentence passage captures the extreme fear mongering at work, comically dropping the words "worry," "fleeing," "urgent," "frightening specter," "fear," "impending," "endanger," and "surliest" in rapid-fire succession.

What could they possibly be so freaked out about? Is it an armed insurrection?

See for yourself (from the New York Times):

"This year, worry that the economic downturn could create an influx of students fleeing private schools has only ratcheted up the anxiety in the city’s wealthier neighborhoods. In the lowest-performing districts, the pressure is more urgent because of a new retention policy that could hold back many failing eighth-graders, raising the frightening specter of hallways populated by bearded teenagers. Many parents also fear that impending budget cuts could endanger the arts and sports programs they rely on to captivate even the surliest adolescent."

For the record, retaining more "failing eighth-graders" -- even at the risk of excessive facial hair -- would do wonders for students who are unprepared for high school. And giving parents more information about how school funds are spent might enhance prioritization in spending, risking fewer valuable programs.

Thursday, December 25, 2008

What if the Kentucky Lottery fails?

The Wall Street Journal reports state lotteries are starting to see declining sales. Kentucky Lottery Corporation sales were still up as of the end of October, the last date of publicly available sales data.

It would be ironic to see a state that talks about raising its cigarette tax to stop people from smoking though it depends heavily on the revenue from cigarette sales also provide lottery revenues to education to the extent that more citizens might better understand what a bad bet a lottery ticket is.

At long last Kentucky needs to stop screwing around with half-baked schemes such as these and undertake pro-growth policies that don't require a suspension of credulity.

Wednesday, December 24, 2008

Yes Virginia, we have another problem

It's amazing that ten weeks have passed without Kentucky's mainstream media even mentioning the reporting of Kentucky Affordable Prepaid Tuition's $35.7 million actuarial shortfall for 2008.

If we had government transparency, we wouldn't need to depend on the Lexington Herald Leader and the Louisville Courier Journal to report on failed, well-intentioned state programs.

And if our politicians had an incentive to think through ponzi schemes like KAPT rather than just signing taxpayers up for another ride because it sounds good, we would save a lot of money.

Thanks for reading the Bluegrass Policy Blog in 2008. Please resolve to inspire those close to you to pay attention to the issues in 2009. We are going to need many more people tuned in fast if we are going to hope to turn things around here.

Where will Beshear go without tobacco tax?

In the 2008 General Assembly, Gov. Steve Beshear couldn't get approval for the casinos he promised to get nor the twenty five cent cigarette tax he promised not to seek.

Today, even the Wall Street Journal knows Beshear has upped his ante (even if they can't spell his name):

"Kentucky Gov. Steve Bashear would raise cigarette taxes from 30 cents to $1 per pack."

It's an interesting article in the WSJ about revenue-enhancing tactics to expect from the states. Read it here.

The Republican Senate has no motivation to give Beshear his tax increase. And despite Beshear's best efforts, House leadership, the state's two biggest newspapers, and every rent-seeking interest group imaginable, neither do many of the rank-and-file members of the House. Tax increases and spending bills require support of three-fifths of the members of each chamber in each odd-numbered year.

Beshear's best chance to keep his head above water without infuriating government-dependent activists is to just borrow the money. And that is surely the route he will take.

Thank your children.

Cutting spending on nonessential government programs remains the only way to not have to repeat this whole ridiculous exercise again next year.

Tuesday, December 23, 2008

Economic development on a cocktail napkin

Given Kentucky's natural beauty, moderate climate, central location, and hard-working people, bringing new business into the state should be as easy for the govenrment as cutting taxes, cutting spending, and getting out of the way.

Having none of that, Gov. Steve Beshear picks now to start a magazine:

I love that they want to sell advertising. What's next, Steve? Gonna start a newspaper?

Someone tell Barack Obama that Kentucky is going to need a little extra bailout money for the glossy photographs.

Why Kentucky needs more health insurers

You probably won't read about Humana's latest dirty trick in the Kentucky media because it happened in Dayton, Ohio:

"Dropping this little bombshell at the end of the year makes it nearly impossible to move Humana insureds to other carriers by the first of January, leaving them vulnerable to out-of-network charges at the height of cold, flu and accident season."

"This is unconscionable."

You can read the whole story by clicking here.

The usual suspects will respond to this with some variation of "See, government should be in charge of healthcare decisions and this wouldn't happen!"

But government has more than it can handle nationalizing banks and car makers and cities and states to pay much attention to the healthcare system -- fortunately. So a market solution may have a chance.

Kentucky could protect its citizens from Humana by blasting the company to bits. But that would just empower Anthem Blue Cross/Blue Shield to do something similar.

Actively encouraging more insurers to come into the state and giving them more freedom to meet customer needs is the only way.

Something like 2007's SB 135, which went nowhere back then, could help bring in more competition.

Kentucky's painful experience has shown us the damage a power-mad government can do to healthcare consumers. Empowering firms to self-regulate by maintaining vigorous competition is the best way to go.

Courier Journal's two-handed "conservative"

President Harry Truman once famously complained about economists who described certain courses of action and then gave rationale for the opposing course ("on the other hand...") by exclaiming "Give me a one-handed economist!"

Readers of the Louisville Courier Journal might have a similar wish after reading token conservative columnist Jon David Dyche rip Gov. Steve Beshear.

Dyche mentions Beshear's squishiness on government efficiency and raising taxes and his "leadership" on casino gambling:

"As a gubernatorial candidate, Steve Beshear opposed higher taxes, claimed to possess the experience and leadership skill to pass expanded gambling, and promised to conduct a comprehensive efficiency study of state government that would save $150 million to $180 million. As governor, Beshear supports raising cigarette taxes 70 cents per pack, has apparently abandoned efforts to expand gambling and is silent about savings from any efficiency study."

Then Dyche does a 180 and advocates for the same thing Beshear wants:

"His proposed increase will produce much-needed money for state coffers in the short term while reducing smoking, improving health and thus saving significant sums on state-sponsored medical care in the long term."

"Slots at tracks would also generate millions for much-needed drug rehabilitation programs, state prisoners in county jails, problem gambling treatment, environmental cleanup and education."

Dyche makes the same mistake tax-and-spenders always do when coveting a new or expanded revenue source -- they spend it all and then wonder where their next fix is going to come from.

The simple fact Dyche overlooks is that Kentucky state revenue is up, it just isn't up enough to pay for all the excessive spending. The problem, and all the solutions, are to be found on the spending side.

Monday, December 22, 2008

Jody Richards: More for me, but none for thee

In the waning moments of the 2008 General Assembly, Kentucky House Speaker Jody Richards got his wish when a previously illegal charter school in his district was made legal.

It's a great deal for the handful of kids who get to go to the Gatton Academy of Math and Science on the Western Kentucky University campus. Your kids probably can't go, but as a taxpayer you will be asked to provide others with this great opportunity.

The main idea is that this opportunity isn't available because the General Assembly doesn't want the rest of Kentucky to escape the mediocre public schools in the state.

Charter schools are public schools that are allowed to operate outside the standard bureaucratic structure in exchange for greater results-oriented accountability.

A bill will pre-filed soon to allow charter schools outside the district of the Speaker of the House. The teachers union and the usual suspects in the bureaucracy are adamantly opposed. This means we have some work to do with the House Democrats in general.

Until then, click below for a view of what they don't want you to have. Eat your heart out:

Why reading legislative bills counts

Washington Post columnist George Will isn't alone in his disgust with the federal auto bailout facilitated by the previously approved bank bailout. Unfortunately, in his haste he overlooks the main problem:

"Congress's marginalization was brutally underscored when, after lawmakers did not authorize $14 billion for General Motors and Chrysler, the executive branch said, in effect: Congress's opinions are mildly interesting, so we will listen very nicely -- then go out and do precisely what we want."

The whole column is here.

What Will misses is the fact that the banking bailout bill allowed this to happen. Congress shouldn't be upset that events played out this way, because its signature is on the dotted line.

Dying for "state approval" in Nicholasville

Because of antiquated "certificate of need" laws in Kentucky, residents of Jessamine county can't have a hospital. St. Joseph-Jessamine, which wants to build a hospital in Nicholasville, can't:

"The emergency room should free up ambulances in Jessamine County, because crews won't always have to bring patients to Lexington, Cassity said."

"Eventually, St. Joseph wants to open a surgical center and a hospital in Nicholasville, said Jeff Murphy, a spokesman for St. Joseph. So far, the hospital group has not received state approval to expand services."

Don't the bureaucrats in Frankfort have something better to do than risk people's lives by infringing on market decisions of willing providers and consumers?

Sunday, December 21, 2008

Battle for freedom never ends

And so, The Bluegrass Institute rarely sleeps and never takes holidays.

During the next two weeks, a lot of things slow down or stop. The march for freedom in Kentucky will not be one of them.

People who want government to get bigger and take more of your money to fund its activities are relentless in pursuit of their goals. Too often, we pay them as they gouge us.

The Bluegrass Institute may be small, but we are driven by our desire to pull Kentucky out of the big government muck and onto the highway toward wider opportunity and greater prosperity.

We hope you will join us for some of the many battles ahead. Meanwhile, please know that the Bluegrass Policy Blog will be updated regularly each day through the end of the year to get a jump on 2009. Check back often, share your comments, and use our email feature to send posts to your friends.

Thank you for a great 2008. We are just getting started!

Saturday, December 20, 2008

Still can't see the man behind the curtain

Gov. Steve Beshear has promised to start putting state government expenditures on the internet on January 1, but it is hard not to expect the most revealing information won't be revealed by the site.

The Bluegrass Institute vigorously supports government at every level in the state becoming totally transparent with our tax dollars, but it has been extremely difficult to get most of the politicians to move past the lip-service stage.

For example, Lexington Mayor Jim Newberry said "I want to make government more transparent," but his new web site provides no tools for allowing concerned citizens to find misspent resources.

The information (comprising contracts, policy memos, and individual expenditures) is available; it just remains hidden.

Real, positive change will not come to Kentucky until transparency becomes more than a buzzword and taxpayers are truly given the information necessary to properly evaluate government spending results.

Friday, December 19, 2008

A discussion we need to have

Rep. Stan Lee has pre-filed a bill to create special needs student scholarships to help some families opt out of their assigned public school when their education needs are not being met.

Given the current political realities in Frankfort generally and in the House Education Committee specifically, it is extremely unlikely this bill or anything like it will get a hearing.

Kentuckians deserve to have more accountability from their public school administrators than we currently enjoy. Can't imagine why they run so frantically from even discussing ways to better serve vulnerable kids in Kentucky.

Anyone inclined to just dismiss the idea out of hand would do well to talk to someone in Georgia, which has already implemented a similar program to the one being proposed here.

How many legislators does it take ... ?

In the 2009 General Assembly, Kentucky has not just one but two bills that would require all movie theaters with five screens or more to install closed captioning technology for deaf or hard of hearing people.

Sounds like a nice thing to do. Surely it is good business if there are enough people nearby who need the service. But do we really need a law and a team of bureaucrats picking out equipment and making private business owners buy it?

This raises an important point about how we are managing the current budget deficit situation. Instead of cutting budgets straight across the board, shouldn't we take this opportunity for a little prioritization?

Uniform cuts make little sense when it means equally fewer resources for rooting out mad case disease as it does for harassing movie theater owners.

Kentucky education now at a crossroads

Kentucky Education Commissioner Jon Draud has resigned citing health reasons, and so we have another opportunity to bring in someone who will shake up the old way of doing things and get us moving in the right direction.

Not that it will happen, but it is another chance.

During this time of transition, however, we should demand each and every school system in the state put all of their expenditures on the internet so everyone can see where our money is going.

That is something we can make progress on while Gov. Steve Beshear moves reluctantly toward more openness in his administration.

Still haven't seen anything on Beshear's promised "efficiency study," by the way.

Thursday, December 18, 2008

Grad Rates About To Change – Thank Goodness!

The Kentucky Enquirer reports that Kentucky is finally about to get honest with its high school graduation rate reporting.

But, don’t credit the Kentucky Department of Education or the Kentucky Board of Education.

This is being forced on the state’s educators by changes I discussed before from the US Department of Education.

One stunning quote from the Enquirer’s article:

“’At a time when most middle-class jobs require more than just a high school education, many states seem willing to accept remarkably high dropout rates,’ said Anna Habash, author of an Education Trust report that says states set graduation standards too low.”

We’ve been saying the same for years. Why didn’t Kentucky’s educators do the right thing on their own -- a long time ago -- without having to have the feds drag them to the honesty table?

It oinks like a pig

What would you do with $680,000 right now? Would you give it to a Eubank, Kentucky couple to shore up their commercial building business?

Well, you just did.

Gov. Steve Beshear just doled out a Community Development Block Grant(CDBG) so O'Neal and Charlene Dishon could shore up Tin Man Manufacturing, LLC in Stanford.

CDBG is taxpayer-funded pork the Bush Administration tried to defund because the program's "lack of a clear purpose."

Gov. Beshear will surely resume his poor-mouthing and tax increase scheming tomorrow.

Why do I see this going badly?

Watching bureaucrats fight each other over borrowed money would be a lot more fun if we weren't picking up the tab.

This is exactly the kind of trouble we should expect from pandering politicians being given increasing amounts of money with which to buy votes. What's really outrageous is that the public sector shows no inclination to learn its lesson.

We must be crazy to give people who have already overspent their budgets more money. It's double-crazy to give them borrowed money.

Louisville surprised by the inevitable

It's a shame the blame game plays such a major role in the government response to economic recession.

Louisville Metro Council President Jim King appears to playing that game in response to a comment from U of L economist Dr. Paul Coombs, who said he didn't see the recession coming:

""Our council trusts Dr. Coomes, and the fact that he didn't see the recession coming lends support to the administration's position that they didn't see it coming," said Metro Council President Jim King, D-10th District."

That failure is beside the point. Economic growth and tax revenues fluctuate. We don't elect our representatives to predict the fluctuations, but to expect them to happen and to rein in spending when times are good.

Yet another argument for limited government.

Wednesday, December 17, 2008

Supply ... and Demand

Gov. Steve Beshear and Attorney General Jack Conway certainly spooked the world oil markets this summer with their gasoline price-gouging press conferences. Oil has fallen more than $100 a barrel since July.

With prices falling the great economic debate will soon be what to do about wages.

In the 1930's, unemployment was kept high by wages that were fixed too high in an effort to artificially spur economic demand. We can only hope President Barack Obama doesn't take the same approach. Here in Kentucky, it's just another reason to repeal prevailing wage laws.

Surely we can find cheaper "volunteers"

State Rep. Carl Rollins actually wants taxpayers to pay state employees to go into the public schools for up to forty hours a year to volunteer.

I wouldn't have believed that if I didn't see it myself.

Rollins could possibly be appointed the chairman of the House Education Committee when the legislature comes back into Frankfort next month.

Did I mention Kentucky isn't exactly doing a good job managing the way it runs our money through public schools?

Like a hate crime on a bicycle

With all the fiscal doomsday scenarios coming out of Frankfort recently, one might expect legislators to be focused on cutting spending to a point within our means rather than putting up more pointless bills seeking to make certain actions even more illegal.

Go fish.

Rep. Jim Wayne (D-Louisville) seems to think reckless driving isn't getting its due as something to not do:

Tuesday, December 16, 2008

Hating the bootleggers, but needing them

The Lexington Herald Leader's Tom Eblen continues the same old drumbeat for a cigarette tax hike with a neat little twist:

"It's a rare occasion when Kentucky legislators can save taxpayers money by raising a tax."

"Gov. Steve Beshear's proposal to raise the state cigarette tax by 70 cents a pack is one of those occasions. The proposal is not only good public policy, it's a financial no-brainer."

Let's be clear: there is nothing "no-brainer" about the full frontal attack on the legislature to raise the cigarette tax.

Eblen can claim, as the big-taxers keep doing, that higher cigarette taxes will save the state billions of dollars in healthcare expenses.

But he gives it away when he blithely dismisses part of the math. You see, Kentucky can't afford to jack up the cigarette tax because of the cross-border retail sales tax revenue we would lose.

Eblen says this:

"Kentucky lawmakers will get a lot of pressure from border-county retailers, who make big bucks selling cigarettes to bootleggers who resell them in high-tax states."

Official revenue estimates for a cigarette tax increase never include the lost revenue from the cross-border activity -- bootlegging -- on which Kentucky's appropriators actually count quite heavily.

And if the tax hikers could botch that part of the equation, how hard would it be to believe they got the healthcare part of this no-brainer wrong?

About as hard as it is to believe that the bootleggers who can drive cigarettes out of state can drive back in, bringing cigarettes to Kentuckians from low-tax states. And those cigarettes would net the state nothing in sales taxes.

The clincher on this "no-brainer" is as simple as loading up the same trucks full of cigarettes that now leave Kentucky headed toward New York and driving them from Missouri to Kentucky.

Then we would need higher taxes on something else to pay for the revenue we just lost. And on and on...

For people who want higher and higher taxes, this looks like a great plan. For the rest of us, it looks like this:

Can't afford it? Don't buy it!

Perhaps Kentucky's state government can't afford to own so many state parks:

"Local Government Commissioner Tony Wilder said no new revenue for the state treasury would mean three to five layoffs in his agency plus more furlough days than the three Gov. Steve Beshear has recommended along with deep cuts in numerous local community projects funded by grants from the state."

"Such gloom-and-doom scenarios were offered up by state officials who said they could be avoided only if the financially strapped state budget receives additional dollars."

The Lexington Herald Leader has a laundry list of nonessential services that are trying to get their constituents organized for a tax increase campaign.

Given Kentucky's growing tradition of spending tax dollars we don't have, however, the proper thing to do is to draw a line in the sand and wave bye-bye to everything on the far side of that line. To do otherwise is to ensure that we never learn from the mistakes that got us where we are now.

Media Muddle on Charters

According to the Louisville Courier-Journal, a new report on charter schools says these parental choice schools are not making much difference. The article cites some biased Indiana legislators claims that the report is excellent ammunition to reign in Indiana’s charter school growth.

At the same time, another newspaper says that a new report claims “Indiana's charter schools growing at fast pace.”

This report also says that charters in the state have high parent satisfaction. In fact, lotteries have had to be used in some schools due to high demand in order to comply with fairness of access requirements. Also, charters are strongest in urban areas in Indiana, which generally would indicate they recruit from lower performing students.

What makes this all more remarkable is that Indiana law is set up to hobble charters – they don’t get money for student transportation or facilities – but they still draw heavily.

By now, you must think the newspapers are talking about different reports. WRONG!

Both papers are talking about one recent report from the Center for Evaluation and Education Policy at Indiana University.

I’ll let you decide which paper has the more open mind about charter schools.

Need another reason to not bail out states?

Gov. Steve Beshear will be jetting to Washington D.C. in January and is certain to celebrate the coming trillion dollar bailout Pres.-elect Barack Obama has promised the states.

And so, states like Kentucky will see little sense in mending their spending practices. In fact, what we are discouraging with all these bailouts is efficiency and responsibility.

Wonder how long we can keep that up?

The latest from the front lines of the financial bailout might help fill in the picture:

"Reports are surfacing that AIG, the recipient of a $150 billion taxpayer-funded bailout, is aggressively cutting its insurance rates in an attempt to win new business and boost market share. If underwriting losses become a problem, the U.S. government may have to provide more financial support. According to Liberty Mutual chief executive Edmund Kelly, "I think it's fair to say they're doing some very stupid things in the market. If (AIG units) are not reined in, it could be very destabilizing for the market.""

Our federal government now appears determined to borrow more money in order to allow our state politicians to campaign for re-election on how great they are at bringing home the bacon.

Hmm. Interesting strategy.

New Report on Education Finance Will Raise Eyebrows

“Educational Spending: Kentucky vs. Other States,” by University of Kentucky economists William H. Hoyt, Ph.D., Christopher Jepsen, Ph.D. and Kenneth R. Troske, Ph.D. is going to surprise a lot of people in Kentucky.

These respected UK economists looked at the money Kentucky spends on P to 12 education, and some of their findings are indeed remarkable. For example:

• Since KERA’s enactment, Kentucky has surpassed all other states in the US Census Bureau’s South-Central region in current expenditures per pupil, rising from fifth to first place ranking among the eight states in the region.

• The gap in current per-student expenditures between Kentucky’s metropolitan and non-metropolitan districts fell from $600 in 1987 to $10 by 2006.

• During the KERA era, districts in the eastern Kentucky went from having the lowest level of per-student expenditures to having the highest. In other words, education spending in our Eastern districts is no longer the same old excuse that it used to be.

• The gap between Kentucky and other states in per-student expenditures narrowed from $2,747 in 1987 in 1987 to about $1,500 in 2006.

In addition, the UK scholars indicate that the way tax supports for schools are divided among local, state and federal sources has acted to reduce local taxpayers’ control over their schools in an inequitable way. While high-wealth school districts still derive an appreciable amount of their total funding from local taxpayers, that isn’t true in low-wealth districts, which are generally located in rural parts of the state. As a consequence, by resisting tax increases when schools don’t perform, parents and taxpayers in wealthier districts have a somewhat more effective say over what happens in their schools than parents in Kentucky’s poor districts do.

Thus Kentucky’s poor and rural school districts are more solidly held hostage to Frankfort and the sometimes peculiar education philosophies that emanate from the capital. Meanwhile, wealthier districts have been more resistant to Frankfort’s ideas and instead have kept a focus on rigorous coursework that better prepare kids for college and life.

Another shocker in the report is the very rapid rise in capital spending that occurred in the state after the 2002-2003 school year. Funding shot up from the lowest among the South Central States to nearly the highest, rising from little more than $200 to nearly $1,200 per pupil in only three years.

Considering that enrollment in Kentucky runs around 650,000 students at present, the latest funding represents a huge annual expenditure of nearly $800 million that no one seems to be talking about.

And, while the report doesn’t mention it, given that Kentucky’s expensive “Prevailing Wage” laws mean that a considerable part of this money is spent on inflated labor costs, the benefits for children are being watered down while special interests clean up at taxpayer expense. Those inflated costs don’t impact what happens in classrooms.

Another cost documented in the report is Kentucky’s high expenditure for administration. As of 2006, tables in the report show that Kentucky has some of the very highest per student administrative costs among the South Central States. Why is that, and are there potential savings here?

Overall, the report’s extensive tables and graphs provide information to raise all sorts of questions about how Kentucky is actually spending its education dollars. So, check it out. Lots of other people will be reading it.

Monday, December 15, 2008

Racing Ohio to the bottom

If you think Gov. Steve Beshear's goverment health insurance pep rally last month was a great example of bad timing, take a look at Ohio:

"The state wants to cover kids in families that make up to 300% of the federal poverty level. The feds have been reluctant to approve this, but the Centers for Medicare and Medicaid Services let a procedural deadline pass last week, essentially giving approval to Ohio's plan."

Hate to think what will happen to Kentucky if Ohio bankrupts itself before we do. I guess we will have a bunch of middle-class families moving here looking for "free" health insurance.

Kentucky Board of Education – ‘Principally’ Confused? – Part 2

I posted a fairly extensive blog on Saturday about a dubious legislative agenda item from the Kentucky Board of Education. The board wants the law modified to allow the Kentucky Commissioner of Education to remove school superintendents and local board of education members in districts where students have had chronically low academic performance for six years.

I pointed out in the previous post that superintendents and local boards have virtually no say about how schools are actually run under KERA. That’s because the real authority to run schools rests with each school’s Site Based Decision Making Council.

Firing the superintendent or someone on the local school board is mostly like shooting innocent bystanders and claiming victory while the real culprits escape any accountability.

Since Saturday I have been checking around, and it looks like the only possible way a superintendent can try to influence what happens in a school is to demote (not fire) the principal. If the principal has tenure in the school system as a teacher (most do), the principal can’t be fired, just demoted. The demoted individual remains in the school system – and on the payroll.

It gets worse. Even if a superintendent removes a school principal for cause, a court case several years ago decided that the new principal isn’t selected by the superintendent. Instead, the very same, low-performing school’s site base council picks the replacement. Imagine that! In fact, in the specific court case I was told about, the site base council actually turned right around and rehired the very same person the superintendent had fired!

Furthermore, if the law is changed and a superintendent is removed, he also has tenure protected if he served four or more years. Since the proposed legislation would only remove the superintendent after six years, the local board would be saddled with more dead weight on their payroll.

So, as I said in the previous post, removing a superintendent or local school board member when kids have low academic performance is mostly a smoke screen for looking tough. Nothing in this proposal is likely to have important impact where it counts – in the schools.

Maybe when we finally see some legislative language on this proposal, I will revise my opinion (the state board voted for this action in principle without any legislative language being considered). However, right now it looks like this Kentucky Board of Education legislative agenda item wasn’t thought through, and this situation probably won’t do anything more than raise more questions about the lack of real effectiveness of the state board and the ability of the system to really make positive changes for kids.

Transparency may not be the Holy Grail...

...but it is amazing that states who have embraced the idea of showing taxpayers where their money is going keep saving money.

Take, for example, Kansas, Missouri, and Texas.

"With these Web sites, Missouri and Kansas residents don’t have to pay government agencies for labor and research time for public records on expenditures and contracts. Conversely, government employees don’t have to take time away from providing state services in order to comply with public records requests."

"Also, the Internet sites promote efficiency and competitive bidding. With access to contracts, businesses can evaluate whether they can offer goods and services to the state at lower prices. And government agencies can evaluate multiple contracts from various vendors and search for volume discounts."

"In Texas, the transparency Web site "Where the Money Goes" cost $300,000 to develop but has saved the state millions because, according to Comptroller Susan Combs, it revealed duplicated contracts that could be consolidated."

If Kentucky really wants to clear up our fiscal situation rather than just raise taxes and expand government, we should immediately set up spending transparency wherever public money is spent in Kentucky.

Beshear creates "tax me more" fund

In 2007, during the Ernie Fletcher administration, Rep. David Floyd filed a bill to let private-sector big government fans put their money where their mouths were.

It got no support from the big mouths in the House.

Today, Gov. Steve Beshear has announced by executive order a Kentucky Commission on Philanthropy. He said:

"We need partners now more than ever, and we must continue to find ways to be responsive to Kentucky families and move the state forward. The time is right to join forces in an unprecedented effort for the greater good of the commonwealth."

Beshear's plan is to raise money to expand programs for government-run education and health programs. One thing that might come as a result of this is that the philanthropists will want to know how every penny is being spent.

On the other hand, when Beshear's tax-me-more fund falls apart, the new programs will need another taxpayer bailout.

Frankfort's next target: your job or your kids?

The New York Times picked up on Kentucky's deteriorating unemployment insurance fund today:

""It is something that we are concerned about," said Kim Brannock, a spokeswoman for the Office of Employment and Training in Kentucky, where the unemployment trust fund balance now sits at $133 million, compared with $250 million a year ago. The fund has not borrowed money from the federal government since the 1980s. "At this point we are solvent," she said, "but we are monitoring the situation.""

Borrowing from the federal government is the first option when these funds run out. Raising taxes is the second.

The message Frankfort needs to get loud and clear is that the gravy train days of big government in Kentucky must end immediately. Tightening spending controls, paying realistic employee compensation, and setting policies that spur economic growth should have been done years ago.

So while Frankfort looks in the months ahead to either borrow or tax its way out of this unemployment mess, citizens need to push for smaller, less expensive government. Otherwise, the current cycle will only get worse. And then so will the next one and the next one...

Sunday, December 14, 2008

Conway supports tax reform, not increase

Lexington talk radio host Leland Conway put out a statement Sunday night in opposition to state income tax increases and the revenue "shortfall" problem:

"We need to make clear that this budget shortfall does not mean that the state is out of money. If you sat down and worked out a budget as though you earned $150K per year, while actually earning $75K per year, you would have a budget shortfall too. You’d have a budget that includes too much spending."

"There is a solution. It’s HB 51 and it will eliminate Kentucky’s income tax on individuals and businesses. It makes up the revenue by adding a sales tax to certain services that are not currently taxed, but it lowers the overall sales tax rate to 5.5% while still exempting items like groceries and most medical supplies and medicines."

"Currently, Kentuckians pay 5% income tax. If you make $50,000 a year, that’s $2500 cash back in your pocket, not counting the savings on the lower sales tax. This bill, pre-filed by Rep. Bill Farmer and co-sponsored by Rep. Stan Lee is a real solution."

"While many other states are begging for bailouts and raising taxes on everything under the sun, Kentucky could be building its future."

Leland can be heard weekdays 9 am to noon on 630 AM WLAP.

When does power grab become corruption?

Just as Kentucky Gov. Steve Beshear is trying to extend the long arm of government deeper into our pockets by raising taxes and expanding his control of healthcare, we find that Illinois Gov. Rod Blagojevich was also expanding his own power with Medicaid funds.

Saturday, December 13, 2008

Kentucky Board of Education – ‘Principally’ Confused?

During the Kentucky Board of Education (KBE) meeting this past week, the members voted in a split decision to ask for legislation that allows the Kentucky Commissioner of Education to remove school superintendents in districts where students have chronically low academic performance (See Item: “Divided discussion at KBOE...”).

It seems like a sensible idea – until you consider the history of how KERA stripped every Kentucky superintendent’s authority to influence what happens in individual schools.

Under KERA, the power to control things like curriculum and the final school level budget was taken away from local boards of education and their executive officer, the superintendent. KERA gave all that power to each school’s site based decision making council (SBDM). Today, superintendents normally have no real say about a school’s curriculum or almost any other important area, including the final selection of the school’s principal. The superintendent can make suggestions, but the site base council makes the decisions.

In fact, Kentucky’s school superintendents are so removed from authority to run schools that about a year or so ago, when the Kentucky Board of Education debated taking the site base council authority from several very low performing schools in Covington and Louisville, the board voted to give that authority to those superintendents rather than to a specially trained Highly Skilled Educator. The argument at the time was the superintendents over those schools could not be considered part of the problem because they had no authority to act in these chronically low performing schools.

During those discussions about the schools in Louisville and Covington, the idea that the superintendent did have responsibility because of the ability to remove the school’s leader was never discussed. The board’s decision to remove site base authority and grant it to the superintendents in those two school districts was justified by the assertion that the superintendents could not be held responsible.

Flash forward to the present. The board’s new legislative request takes direct aim at superintendents and local boards of education with low performing students. But, how can this really help much, unless the stipulation is added that the superintendent has to have site base control for six years, first? That added stipulation was not discussed in the relevant Staff Note for the Board’s meeting nor in discussions during the meeting, which I attended (Find the staff note proposal under the item “BLUE RIBBON PANEL ON INTERVENTIONS IN LOW-PERFORMING SCHOOLS RECOMMENDATIONS").

There are more problems with the proposal. Local boards of education are elected, while the Kentucky Commissioner of Education and the Kentucky Board of Education are all just appointees. How much authority should an appointee have to override the will of the people? Some of this authority has existed in the relevant sections of statute (KRS 156.132) for a long time, but that doesn’t mean it is the right way to operate. Also, since KERA completely severed all responsibility of the local school boards for anything that happens in a school, how can removing local board members due to low academic performance do anything effective to improve education for kids? Local board members have even less power over academic performance than the superintendents do.

So, here are some questions.

Can someone tell me where a superintendent’s power to remove a principal is defined in the law? How about the laws regarding a local board’s authority to remove the superintendent? Is low academic performance mentioned as a cause of action for either case?

Also, if a principal is removed, what is the process to select a new principal? Does the school site base council get to do this, or in this unusual circumstance does the superintendent select the replacement (which is normally forbidden by the Kentucky Revised Statutes, as emphasized by court decisions).

Certainly, this new legislative request conflicts with the actions the board took in Louisville and Covington to remove site base council authority and place it in the hands of superintendents.

I’ll be digging on this one, because it looks like the proposed legislation makes no sense and is even inconsistent with actions the Kentucky Board of Education has taken in the past. Right now, this is shaping up as just another example of how the people who have the real authority for education have been effectively shielded from any true accountability while others are held as scapegoats. Before a single local board member gets fired, there better be some evidence that educators in the responsible school faced some effective accountability, first.

We need limits on political emissions

Matthew Dowd just said on Good Morning America that on January 20, 2009 Barack Obama is going to "own" the economy. Dowd was a senior strategist on the Bush campaign in 2004.

Sheesh.

Gov. Steve Beshear exhibited the same kind of conceit Friday when talking about the auto bailout:

"We cannot let the automotive industry fail," Beshear said. "It would be devastating to Kentucky’s economy – and to Louisville’s vitality."

Before he speaks about this again, Governor Beshear should seek to understand that "we" didn't cause the auto industry's problems so that he can explain why he thinks "we" are now responsible for propping them up at the comfort level to which the industry has grown accustomed.

And it would be great if Beshear could explain how General Motors and Chrysler declaring bankruptcy is going to devastate Louisville's "vitality." Does he really mean Louisville is going to die or was that just another political emission?

Friday, December 12, 2008

Now this could get interesting

Rep. Melvin Henley's pre-filed bill stripping welfare benefits from drug abusers has received one serious objection that weighs particularly heavily now that everyone is talking about budget deficits: cost of drug tests.

Rep. Ted Edmonds may have an answer. House Bill 78, pre-filed Friday, would require health insurers to cover drug tests ordered under such circumstances.

I'm generally not a big fan of health insurance mandates, but Henley's bill requires welfare recipients authorities have reason to believe are abusing drugs to either take a drug test or lose their benefits.

I'm guessing most drug abusers would not bother to go through the exercise of taking a drug test so the costs would be very, very small.

Paper gets to tax point, eventually

The Frankfort State-Journal is like a box of chocolates, especially when they start talking about tax increases.

The headline of a Friday news story reads "Schools pleased cuts don't touch their $3 billion fund." The story doesn't mention until the 8th paragraph that Gov. Steve Beshear's "spending cut" proposal depends very heavily on General Assembly passage of his tax increases.

And the discussion of the tax increases remains a mixed bagged for several paragraphs as the effort to sell the Beshear cigarette tax increases fails to get any more rational than it has been:

"Rich Crowe, superintendent of Frankfort Independent Schools said he supports Beshear's proposed tax increases on all forms of tobacco "to help save education funding and to bring the deficit under control.""

And this:

"Franklin County Judge-Executive Ted Collins said Thursday he supports Beshear's tax increases on tobacco."

""I know cigarettes are high for people who smoke," Collins said. "But I think that's an area we can increase the tax on. It will help the state budget and will help the health of the commonwealth as well.""

The State Journal then managed to hit the bulls-eye with a quote that nailed the cigarette tax increase as a gateway drug for big spenders:

"Magistrate Lambert Moore said with the proposed tobacco tax increase, "you're balancing the budget on the poorest people in the state, the smoking public."

""Then you are relying on that money and the money is going down because people will quit smoking. So you're going to have to raise taxes somewhere else to get that money.""

Missouri did an efficiency study

While Kentucky flounders in an overspending crisis, Missouri doesn't.

Two big differences: rather than talk ad nauseum about doing an efficiency study and then not do one, Missouri Gov. Matt Blunt cut waste and saved a bundle. And rather than talk the talk about posting spending data to the internet for taxpayers to watch, Blunt walked the walk.

Not that complicated.

Thanks to Andy Roth at the Club for Growth for passing this along.

Would car maker survival be big gov disaster?

General Motors and Chysler hired bankruptcy lawyers recently to help work out their own solution as big government bailout hopes waned.

With defeat of the bailout bill Thursday, the Detroit situation becomes analogous to the one in Frankfort. State agencies have been predicting widespread death and destruction should they be forced to make do with less taxpayer money.

Might be interesting to see the political fallout if part of the auto industry survives sans bailout. Same goes for Frankfort.

Thursday, December 11, 2008

Governor’s Budget Plan Could Go Up in Smoke

I was at the Kentucky Board of Education meeting today when the governor made his announcement about proposed budget changes to deal with the current fiscal situation.

Board members were relieved when it was announced that the governor’s plan exempts the school funding system, known as SEEK, from any cuts and hits the department of education in other areas for a less-than-average two-percent reduction.

Then, the Grinch arrived. A board member pointed out this is all contingent upon a 70 cent hike in the cigarette tax. If the governor doesn’t get the revenue that is anticipated from that huge tax hike, then all promises are off.

Beshear's bailout bumble

Gov. Steve Beshear, fresh off his tax increase press conference this morning, now wants your money for the auto bailout. He said:

"I am pleased that the House of Representatives passed last night emergency loans to the automotive industry, and I urge the United States Senate to quickly take the same action. At this time of economic uncertainty, I believe Congress should do everything in its power to assure that the auto industry maintains a strong economic foundation."

Correcting it's problems by reversing bad business practices would certainly be a better way to build a "strong economic foundation" would work better than keeping the bad practices and taking taxpayer money.

Sanity to the rescue

Secretary of State Trey Grayson shouldn't have to teach Gov. Steve Beshear about forward-looking fiscal policy.

In response to Beshear's tax increase press conference today, Grayson said:

"Comprehensive tax reform that will reduce the tax burden on productivity, and thus allow our economy to grow, is the only real answer to this crisis. Until we face this fact, our Commonwealth will continue to bear these difficult decisions."

Thanks for stepping up, Secretary Grayson. Too bad there is not enough of this sentiment in the legislature. Tax increases are not part of the answer when too much government spending is the biggest part of the problem.

Dead On Arrival

Gov. Steve Beshear plans to announce his tax increase proposal in a 10 AM press conference.

Wednesday, December 10, 2008

"Look Mom, no fiscal restraint!"

It appears nothing stops the forward progress of big government.

The Infectious Greed blog passed along the following bond addendum filed by the state of Illinois in the process of trying to borrow $1.4 billion after the arrest of Gov. Rod Blagojevich.

It's not the same thing, but when I saw this it immediately made me think of a very similar dollar figure that some in the state of Kentucky want to keep quiet.

Yes, Sometimes School People Do Steal from Parent Funds

Only yesterday I wrote about the proliferation of fees and dues that parents have to fork over to schools for everything from lockers to extra curricular activity participation. I mentioned that the virtual absence of decent accounting for this money was an open invitation to theft.

Now, just one day later, this article surfaces about the swiping of parent provided funds collected for school playground equipment.

Notice that these thefts took place over a fairly long period and only came to light because the crook got greedy and overdrew the account. This thievery was not discovered by an audit process, which was obviously inadequate, or may not have existed at all.

So, yes indeed, the Kentucky Department of Education needs to get with it and set up a decent accounting program for school dues and fees. With some schools’ dues and fees accounts now totaling more than $300,000 annually, this protection for parents should have started a long time ago.

Propaganda in my Inbox

It would really only be newsworthy if House Budget Chairman Harry Moberly called a press conference and said "We have been overspending in Frankfort for many years. Our public employee fringe benefits program is tens of billions of dollars in the hole and we have accumulated billions more in bonded indebtedness just to buy votes. We're sorry and we will cut the nonsense immediately."

Instead, we get this:

Why isn't the headline on this story "Moberly wants $500 million tax hike?"

Big government still Frankfort's problem

November revenue figures out this morning for Kentucky's state government continue to indicate overspending -- and not a revenue shortfall -- plagues efforts to balance the budget.

According to Acting State Budget Director John T. Hicks, combined General Fund and Road Fund receipts last month were $31,016,766 higher than in November 2007.

In the fiscal year since July 1, receipts are $45.1 million higher now than at the same time in 2007.

Again, cutting out wasteful policies like prevailing wage and corporate welfare and straightening up the accountability issues with K-12 education spending should come well before any of the currently threatened tax increases.

Tuesday, December 9, 2008

Where Mitch McConnell earns his pay

Congress and the White House appear to have worked out a $15 billion auto bailout.

From the Associated Press:

"Sen. Mitch McConnell, R-Ky., said he was concerned that Democrats were proposing a package that "fails to require the kind of serious reform that will ensure long-term viability for struggling automobile companies.""

"With their approach, "we open the door to unlimited federal subsidies in the future," McConnell said."

Hold that thought, Senator.

An experiment worth trying?

While Kentucky school officials are talking about maybe losing 4% of their state funding, Kansas schools this month got a 25% haircut:

It comes as quite a shock for a Kentuckian to see the Kansas education official say that they had been able to make it work.

Could the same thing fly in Kentucky? We don't really know because fiscal accountability in Kentucky schools is so bad.

Fees and Dues in Kentucky’s Schools

No Standards

No Accounting

Laws Violated

Kentucky’s Constitution requires a system of free public schools, but that is probably a surprise to most parents. On December 9, 2008, the Kentucky Office of Education Accountability (OEA) reported to the legislature’s Education Assessment and Accountability Review Subcommittee that most schools charge students widely varying amounts for dues, fees and supplies. The OEA also noted that there are inadequate standards and no real accounting for these programs, and that federal laws are being violated.

Parents get hit with all sorts of school expenses. For example, Kentucky’s schools require parents to spend personal money for student supplies such as pencils, paper, glue and scissors.

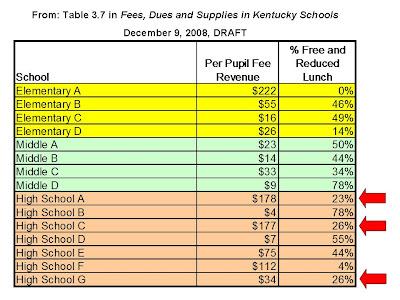

In addition, schools often collect fees and dues for such things as clubs, parking, and team memberships. Examples cited in the OEA’s presentation included an average fee to join middle school dance teams of $190 (Yes, that is only the average) and a nearly as high $165 average fee for a middle school student who wants to be a cheerleader. Furthermore, data I extracted from Table 3.7 in the OEA report (Report not yet on line -- see the table below) shows that per-pupil fees can be very different even in schools with generally equal poverty rates (note the three high schools highlighted with the red arrows -- eligibility for the federal free and reduced cost lunch program is a commonly used indicator of student poverty rates)

Detailed information about the dues and fees system is lacking because the accounting of these programs is wild, uncharted territory. The OEA indicated that the Kentucky Department of Education has no standard reporting process to monitor dues and fees programs. While the OEA didn’t mention it, that opens the door for fraud and abuse, which has occurred in the past with these sorts of funds.

The OEA did mention another legal issue, saying that some schools hold student education records hostage to force parents to pay dues and fees. That, the OEA points out, is a direct violation of the federal Family Education Rights and Privacy Act.

The OEA also jumped on the eternal hot button topic under KERA – equity in funding for schools. With total fee revenues in the seven sample high schools running from a low of just $2,620 to an astronomically high $313,492, some kids clearly get a lot more from school than others. Thanks to the absence of reporting, the KERA funding system doesn’t see this inequity at all.

If your school charges outrageous fees, and especially if they hold student records hostage for non-payment, we’d like to hear about it. Let your legislator know, too.

Beshear in Wonderland

Gov. Steve Beshear told reporter Pat Crowley:

"Obviously, if I reach that point where I feel we can’t do this whole thing by just cutting, (the cigarette tax) is one of the obvious areas I would turn to,” he said. "I think the vast majority of people support an increase in that tax anyway, it would give us substantial revenue and it would give us some great health benefits."Clearly, a "majority" of people prefer getting government checks rather than paying taxes, but that doesn't make it right or good. Further, to figure that a cigarette tax increase will raise "substantial revenue," one must ignore the lost retail activity from the people in five surrounding states who will no longer come to Kentucky for cheaper cigarettes. And how great are the revenues going to be if people either opt for the "health benefits" of not smoking or the alternative of black market or online cigarette purchases?

The big spenders in Frankfort will have Cheshire Cat grins for sure if we fall for this flimsy reasoning and open the door to tax hikes in a fake attempt at resolving our overspending problem.

Sharpen your pencil, Mayor Newberry

Lexington Mayor Jim Newberry this morning urged taxpayers to let him delay further the day of reckoning for the city's fire and police pension funds, already underfunded by $246 million.

In a statement, Newberry said:

"By issuing a series of bonds over the next 5-6 years, we can (a) fully fund the Fund in 5-6 years, (b) phase in the added financial obligations, and (c) avoid the dire consequences of an across the board reduction in local government services."

Lexington previously scheduled to sell $70 million in pension bonds in 2009. Contract debt is already the third largest item on the city's list of current liabilities.

To his credit, Newberry appears ready to lower pension benefits to ease the burden on future taxpayers:

"Tomorrow, I'll discuss the need to change the benefits for our new hires so we don't find ourselves in similar predicament in the future."

It seems that with the mounting debts, however, cities like Lexington are headed inevitably to an inability to provide lavish lifestyles for layers of bureaucrats running superfluous programs and tying up resources that could be put to better use in private hands.

Putting all government expenditures on a searchable web site would be a great way include taxpayers in the process of getting spending under control.

Monday, December 8, 2008

College Confusion

Two news articles running within days of each other provide more evidence of the massive amount of confusion the public is getting about the real education situation in Kentucky.

Over near the East end of the state, the Daily Independent in Ashland complains that college enrollment in the state is moving in the “Wrong Direction.” The paper laments the drop in freshmen enrolling in Kentucky’s university system this fall, placing the blame on the rising cost of tuition.

The tuition rise seems like a reasonable explanation for the enrollment fall-off – until you read the Courier-Journal’s “Valley closes college ‘deal.’” The Courier reports that seniors at the Valley Traditional High School in Louisville just attended an event where they were encouraged to go on to college by representatives from 16 colleges. These students got a host of financial information about how kids from this high poverty school can afford to go on to postsecondary schools.